9:00 a.m - 8:00 p.m

Opening Hour Mon - Fri

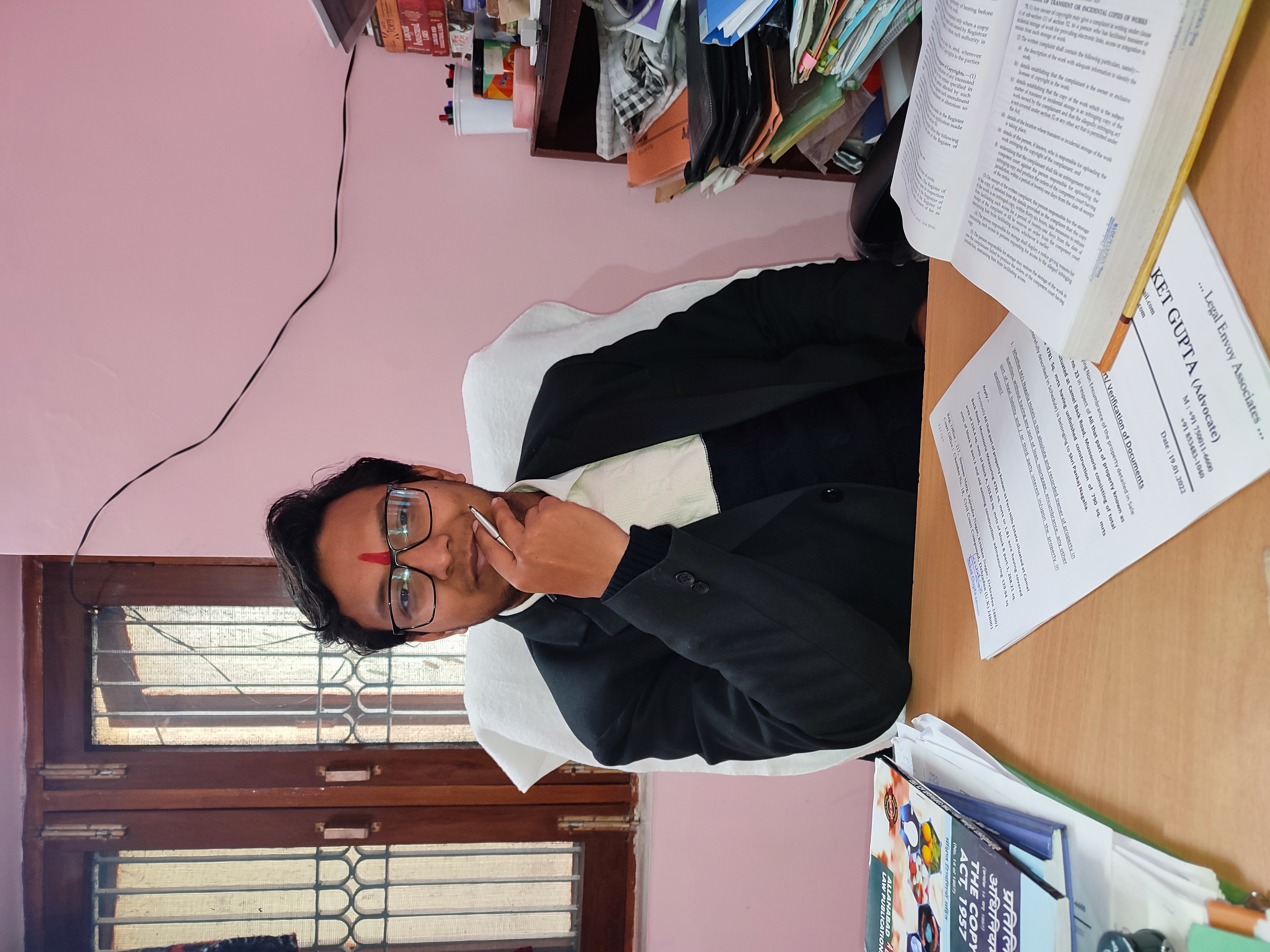

Govt Approved

Expert Attorneys

99.99% Case Won

Quick Support

We are a group of expert lawyers dealing with tax matters, check bounce cases, civil law, property registry, family matters etc.

We provide full satisfaction to all our customers at reasonable rates. We are located in Dehradun, Uttarakhand. We also provide online consulation on request. We guarrantee full privacy to all our customers in all matters.

We are Working with a special focus on Legal/ NEC / TIR / Taxation and Civil Cases (compliance related matters) as an Advocate. We also render services to our clients on wide range of issues relating to contract laws, insurance, motor vehicle, taxation and criminal laws.

We provide A to Z taxation services like - Company incorporation, Partnership Firm, Tax and GST Audit, Income Tax, Sale Tax and GST litigation, GST return filling, Income tax return filling, EPF, ESIC, Fssai (Food Licence), DSC (Digital Signature), Accounting, Book Keeping etc.

Laws and principles are not for the times when there is no temptation: they are for such moments as this, when body and soul rise in mutiny against their rigour ... If at my convenience I might break them, what would be their worth?

All types of Deed - Sale deed, Partnership deed, Gift Deed, Lease deed, Mortgage Deed, Will, Transfer Deed qnd related work like Marriage Registration and Certified Copy of Deeds. Verifying and preparing of TIR/NEC/Legal report.

Verifying and preparing of TIR/ NEC/ Legal report with the government records and looking on the related cases.

Cheque bounce cases, Bail under BW.

Matrimonial cases - maintenance, Mutually Divorce, Guardianship, Domestic violence etc.

We are expert lawyers with experience in the field. We have provided services to thousands of clients.

We resolve all matters discretely in an efficient manner.

Satisfaction of the customer is our highest priority.

Advocate

Advocate

Saket is really good lawyer. He is well informed, and has a very helpful nature. He helped me on a very tricky situation with sound and straightforward advice without making me jump loops. His charges are also very reasonable. Will highly recommend Saket. We need more lawyers like him in the judiciary.

Definitely, a reliable person I know. Thanks for being there. Highly recommend.

Good service, Not money minded, reasonably charging.

Saket gupta ji you are such a good person. I have heard about your from one of my friend but i haven't belived at that time that you are such a good person, but after a single great meeting with you i have reaslised that my friend was right. thank you soo much for the great time and wonderful profesional work.

Adv Saket Gupta is a very kind hearted and helpful person. He has helped many people during covid pandemic, inspite of his schedule and his own personal loss. Always available to people when they asked for help. Best wishes for his future.

A Professional who know how to keep his commitment.

Saket ji has did my work within unexpected time. Thank you soon much you are such a very good advocate.